Outlook on the Evolution of Energy

Read more about the most recent insights, with commentary from energy investment experts.

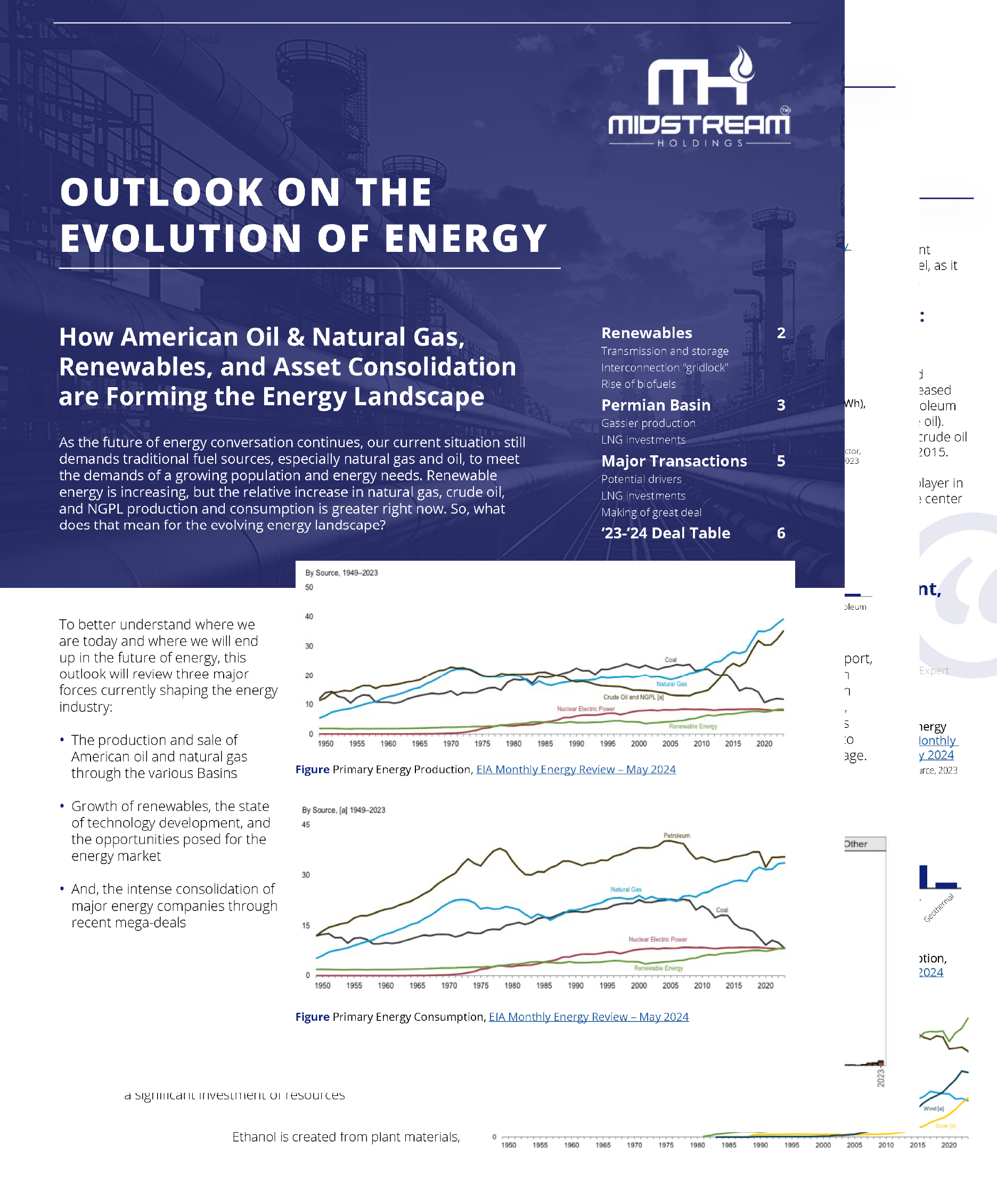

The energy industry, which involves both traditional (oil and gas) and emerging (hydrogen and renewables) fuels, is a major player in the global economy. As the demand for energy continues to grow, the industry has seen a significant increase in mergers and acquisition (M&A) transactions. These transactions help companies by scaling up or down to overcome turbulence in the market and cutting costs for non-core business activities.

Asset acquisitions and divestitures are important in the energy sector because they drive growth in the energy industry. This is also why qualifying buyers is an essential part of making successful transactions. In this article, we will discuss the criteria you should judge potential buyers on to ensure the success of asset acquisitions and divestitures.

Substantial capital is needed to acquire energy assets. Buyers must have access to capital sources, including equity, debt, and joint ventures, in order to finance their acquisitions. Creditworthiness is another crucial factor that buyers should take into account. Credit ratings can impact financing options and the terms of a transaction, so having a strong credit rating is essential in this process. Keeping that in mind, historical financial performance is another key indicator of a buyer’s ability to secure a transaction. A solid financial track record can help to increase the confidence of sellers.

Marathon & Conoco: The deal between Marathon and Conoco is expected to yield $500 million in cost savings within a year. In this transaction, Marathon and Conoco agreed to an all-stock transaction to benefit both parties.

Enbridge & Questar: Enbridge’s purchase of Questar Gas from Dominion Energy, which was a $9.4 billion cash and $4.6 billion equity deal, reflects their financial robustness. The acquisition, which reportedly expanded Enbridge’s utility operations, showcases their ability to strategically invest and enhance their assets.

Relevant experience in the energy industry is another vital qualification for buyers. Previous experience will tell you if a buyer possesses the necessary skillset to efficiently handle the assets. Moreover, buyers should also have effective asset management to show they are capable of managing and optimizing energy assets post-acquisition. This can include strategies like implementing best practices and enhancing an asset’s performance. It is also important that a buyer understands and adheres to regulatory requirements in the industry. Buyers must be compliant with any and all environmental, safety, and operational regulations to ensure smooth operations.

Marathon & Conoco: This deal underscores ConocoPhillips’ technical and operational expertise. The anticipated cost savings indicate their capability to manage and optimize new assets effectively, which is an example of their industry expertise.

Enbridge & Questar: Enbridge’s integration of Questar Gas highlights their technical expertise. This acquisition of Questar’s extensive pipeline network demonstrates Enbridge’s ability to manage complex assets within the energy industry, all while maintaining regulatory compliance.

Acquisitions should align with the buyer’s strategic objectives and the ultimate long-term vision of their company. Buyers should take care to identify assets that match with their existing operations, ensuring adjacencies with optimized revenue and cost structures. Integration capability is another essential factor that should be considered, as there may be several challenges that need solutions throughout the integration process. Buyers should possess the necessary skills for addressing these integration challenges so new assets can integrate seamlessly into existing operations. Lastly, strategic acquisitions can enhance a buyer’s market position and give them a competitive advantage.

Beneficial transactions, which starts with a qualified buyer, should be accretive to the bottom line. In successful past deals, buyers and sellers could take advantage of dividend growth through long term ratable, stable cash flows.

Marathon & Conoco: ConocoPhillips’ acquisition of Marathon Oil aligns with its long-term strategic goals. The expected savings and enhanced market position aligns with ConocoPhillips’ vision of financial growth, increased value, and long-term benefits.

Enbridge & Questar: Enbridge’s acquisition of Questar Gas fits well with their strategy to reportedly expand utility operations. The integration strengthens Enbridge’s position in the market and operational reliability, supporting its long-term vision of growth.

In summary, the success of asset acquisitions and divestitures requires the seller to qualify the potential buyers. Comprehensive evaluations are important because they can ensure that buyers meet the needs of the transaction, achieving growth in the long run. As the energy industry continues to evolve, these qualifications will remain the determining factor in the outcome of future asset transactions.

Discover transparency when it comes to A&D by working with Midstream Holdings to gain valuable transparency into asset valuations. By utilizing the Midstream Holdings platform, individuals and companies can efficiently list and effectively navigate the midstream landscape. For those looking to learn more about the dynamic world of midstream acquisitions and divestitures, Midstream Holdings can open new doors that lead to discovering exciting opportunities.