eBook

Outlook on the Evolution of Energy

This downloadable eBook walks through three topic areas relevant to the current state of the energy evolution: renewable and alternative fuels, the production and sale of assets in the various Basins, and the intense consolidation of major companies. Read more about the most recent insights, with commentary from energy investment experts.

State of the Industry: Renewables

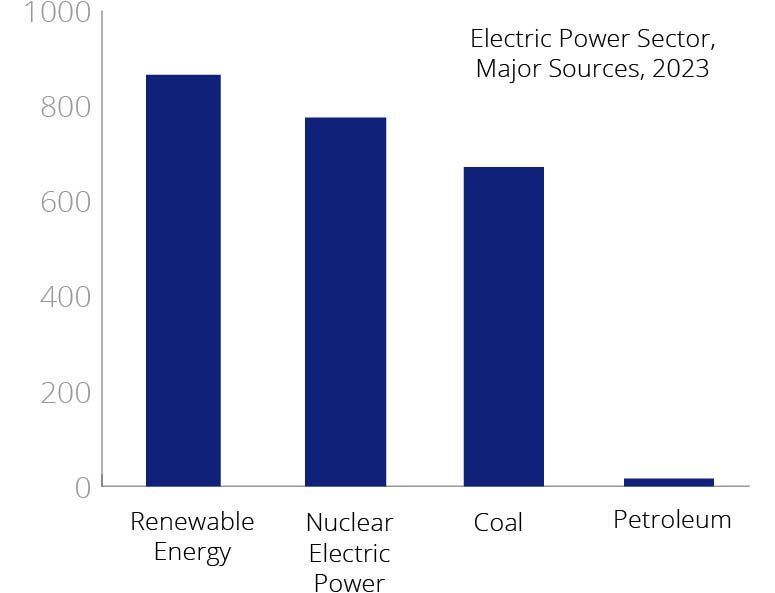

According to the Energy Information Administration, natural gas and renewable energy resources were the top two producers of electricity in the United States in 2023. Renewable resources have surpassed coal and nuclear electric power in the past several years, posing a major impact on the traditional energy mix.

State of the Industry: Permian

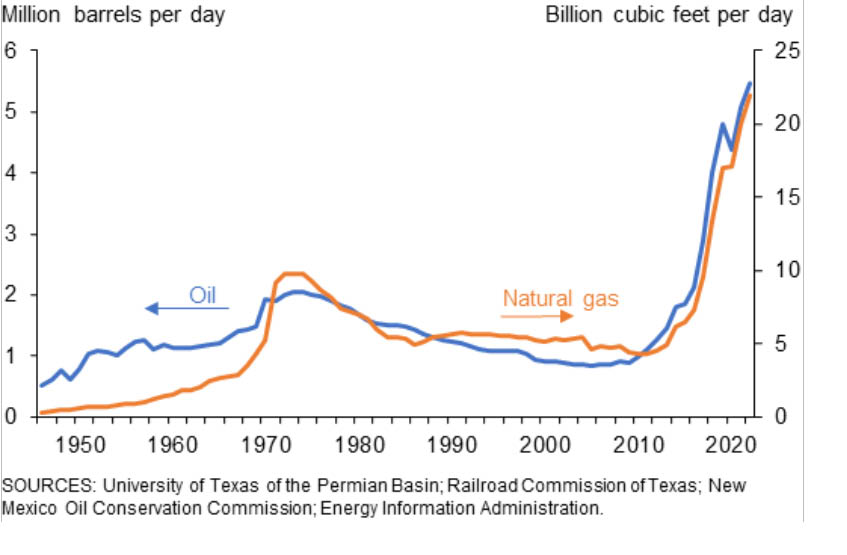

Since the early 2000s, the United States’ energy exports have increased substantially for fossil fuels (petroleum products, natural gas, and crude oil). The increase in natural gas and crude oil really started to takeoff around 2015.

The Permian has been a major player in bringing the United States to the center of the world stage in energy exports. In 2023, the United States produced 22% of the world’s total oil production, depending on prolific oil fields like those located in the Permian.

State of the Industry: A Year’s Worth of Major Acquisitions & Divestitures

There has been a notable rise in mergers, acquisitions, and divestitures in the past year, and the resulting consolidation has had an impact on the makeup of the market landscape. Mega-deals, like ONEOK and Magellan Midstream, ExxonMobil and Pioneer, and ConocoPhillips and Marathon, are driving growth and scale in a market that is unfriendly to new construction or investments in traditional fuel sources.

In the first quarter of 2024, there was $12.5 billion in midstream deals, compared to the total $21.9 billion in all of 2023.

Read the full eBook.

Ready to get started?

Create an account today to browse the Midstream Holdings platform

© 2024 Midstream Holdings